What are the types of FX risks faced by cross border businesses?

What are their characteristics and differences?

Introduction:

In our previous article, we learned that out of the three common types of risks, businesses can actively safeguard against FX risks in comparison to policy and demand risks. In this week’s article, we will delve deeper into the different types of FX risks faced by companies and their distinguishing characteristics.

What are FX Risks ?

As previously mentioned, risk was originally meant to be a neutral term, denoting the possibility of both profit and loss. In its broadest sense, businesses can gain or lose from large FX fluctuations in the FX market. On the other hand, if we were to hew to a stricter definition, FX risks due to large fluctuations in the FX market can result in losses for businesses. In most common cases, as in this article, ‘risk’ follows the stricter definition of the word.

Three Types of FX Risks:

1.Transaction Risks

Transaction risks refers to the effects that foreign exchange rate fluctuations can have on a completed transaction prior to settlement, which affects account receivables and payables.

Transaction risks are mainly present in:

First, trade relations where import and export of goods or services are subject to immediate or deferred payment based on credit. After the shipment or service is completed, the exporter is exposed to the risk of weaker FX rates that can reduce export income while the importer is exposed to the risk of appreciating FX rate that can impact import expenditure – demonstrating the risk of holding accounts payables and receivables in foreign currencies.

Second, international investment and lending denominated in foreign currency with outstanding claims and debts. This refers to the exchange rate risk of holding foreign currency debt that can change in value based on fluctuations in the FX market.

| Example:

A European company that imports large machine tools from an American supplier uses USD in their bid pricing. However, due to fluctuations in the USD, the firm faces considerable transaction risk. In March 2022, the firm signed an import agreement with its American supplier valued at 10 million USD with a down payment of 20%, while the remaining 80% was scheduled for payment after three months. At the time of the agreement, 1 EUR could exchange for 1.1 USD.

However, by June, as a result of monetary policy changes in both Europe and America, the Euro’s value fell to 1.05 USD. With 80% of the payment outstanding, the firm had incurred an exchange rate loss of 346,320 EUR, with import costs rising by approximately 5%.

2.Economic Risks

Economic risks refers to the risk caused by exchange rate fluctuations that may result in firms facing losses in terms of future earnings. Potential economic risks are directly related to the benefits of engaging in cross-border business operations. The depreciation of exchange rates in export destination countries usually suggests a decline in the economy and a decline in real purchasing power. As an exporter, the decline in the volume of merchandise sales has a huge impact on sales revenue. Therefore, for export firms, changes induced by economic risks are more critical than those triggered by transaction risks or accounting risks.

| Example:

A Sri Lankan tea exporter who mainly exports to India, offered to settle its transactions in USD due to uncertainties surrounding India’s economic situation and rupee exchange rate management. As a result of international geopolitical and economic volatility, the INR depreciated 4.7% against the USD , resulting in a decline in local purchasing power in India, 20% reduction in annual sales and 10% decrease in total revenue for the exporter.

3.Accounting Risks

Accounting Risk refers to possible book losses as a result of exchange rate fluctuations when the economy converts functional currencies into presentation currencies while managing its balance sheets. When evaluating its operations, multi-national corporations consolidate the accounting statements of their subsidiaries into a single, uniform statement. The gains or losses incurred in the conversion of prices when the functional currency used by the subsidiary (Currency of Account) is inconsistent with the parent company are the accounting risks.

| Example:

A large Singaporean oil and gas MNC operating in Europe, United States and emerging markets has subsidiaries in Brazil, Russia and Canada managing oil and gas resources. It has annual foreign currency revenues and expenditures totaling approximately SGD 1.6 billion. In 2015, economic growth slowed in Canada and Brazil, causing the BRL to depreciate against the SGD by 39% and the RUB declined against the SGD by over 10%. As a result, the investments, assets and revenue of the Brazilian and Russian subsidiaries amounted to a 25% loss of SGD in the parent company, resulting in an 11 % decline in total annual earnings of the enterprise.

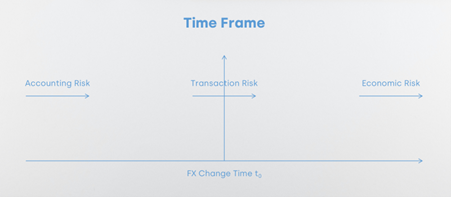

By evaluating the risks according to time, accounting risks and transaction risks are effects of exchange rate changes on past or existing agreements. On the other hand, economic risks are the effects of exchange rate changes on future net returns as shown in the figure below

From a cash flow point of view, transaction risks and economic risks relate to the cash flow of the firm and will result in tangible losses or gains for the risk bearer. On the other hand, accounting risks mainly affect the corporate balance sheet and profit statement, and does not relate to cash flow, but rather results in book gains and losses.

As such businesses need to understand the different types of FX risks and evaluate their exposure to each type in order to develop a comprehensive risk management strategy. As mentioned above, understanding the time value of the FX risks will also help firms better safeguard against loss of revenue due to FX fluctuations. If this all still seems a little too foreign to you, in our next article, we will explain the necessity of foreign exchange risk management for enterprises. If you are interested to learn more, follow us on LinkedIn to keep up to date on new articles or you can you can visit our website to see how SUNRATE can help your business with your FX needs.

Share to

We hope to use cookies to better understand your use of this website. This will help improve your future experience of accessing this website. For detailed information on the use of cookies and how to revoke or manage your consent, please refer to our < privacy policy >. If you click the confirmation button on the right, you will be deemed to have agreed to use cookies.